Macroeconomics

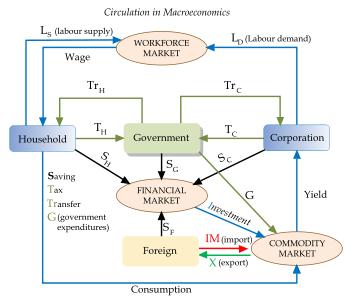

Macroeconomics is a branch of economics that deals with the performance, structure, and behavior of a national or regional economy as a whole. Along with microeconomics, macroeconomics is one of the two most general fields in economics. It is the study of the behavior and decision-making of entire economies. Macroeconomists study aggregated indicators such as GDP, unemployment rates, and price indices to understand how the whole economy functions. Macroeconomists develop models that explain the relationship between such factors as national income, output, consumption, unemployment, inflation, savings, investment, international trade and international finance. In contrast, microeconomics is primarily focused on the actions of individual agents, such as firms and consumers, and how their behavior determines prices and quantities in specific markets.While macroeconomics is a broad field of study, there are two areas of research that are emblematic of the discipline: the attempt to understand the causes and consequences of short-run fluctuations in national income (the business cycle), and the attempt to understand the determinants of long-run economic growth (increases in national income).

Macroeconomic models and their forecasts are used by both governments and large corporations to assist in the development and evaluation of economic policy and business strategy.

Development of macroeconomic theory

The first published use of the term "macroeconomics" was by the Norwegian Economist Ragnar Frisch in 1933, although a similar expression occurred already in the work of Eugen Bohm-Bawerk, and there was a long existing effort to understand many of the broad elements of the field.Classical economics and the quantity theory of money

Until the early twentieth century, the quantity theory of money dominated as the favored macroeconomic model among classical economists. This theory gives the equation of exchange:

M · V = P · Q

The equation states that the 'money supply' times the velocity of money (how quickly cash is passed from one person to another through a series of transactions) is equivalent to nominal output (price level times quantity of goods and services produced). Classical economists, such as Irving Fisher assumed that real income and the velocity of money would be static in the short-run, so, based on this theory, a change in price level could only be brought about by a change in money supply. This equation is the central foundation for the economic school of thought known as monetarism. The classical quantity theory of money assumed that the demand for money was static and independent of other factors such as interest rates. Economists questioned the classical quantity theory of money during the Great Depression when the demand for money, and thus the velocity of money, fell sharply.

Keynesianism

Until the 1930s, most economic analysis did not separate out individual behavior from aggregate behavior. With the Great Depression of the 1930s and the development of the concept of national income and product statistics, the field of macroeconomics began to expand. Before that time, comprehensive national accounts, as we know them today, did not exist. The ideas of the British economist John Maynard Keynes, who worked on explaining the Great Depression, were particularly influential.

After Keynes

One of the challenges of economics has been a struggle to reconcile macroeconomic and microeconomic models. Starting in the 1950s, macroeconomists developed micro-based models of macroeconomic behavior, such as the consumption function. Dutch economist Jan Tinbergen developed the first national macroeconomic model, which he first built for the Netherlands and later applied to the United States and the United Kingdom after World War II. The first global macroeconomic model, Wharton Econometric Forecasting Associates LINK project, was initiated by Lawrence Klein and was mentioned in his citation for the Nobel Memorial Prize in Economics in 1980.

Taking their cue from Friedrich Hayek, theorists such as Robert Lucas, Jr. suggested (in the 1970s) that at least some traditional Keynesian (after John Maynard Keynes) macroeconomic models were questionable as they were not derived from assumptions about individual behavior, but instead based on observed past correlations between macroeconomic variables. However, New Keynesian macroeconomics has generally presented microeconomic models to shore up their macroeconomic theorizing, and some Keynesians have contested the idea that microeconomic foundations are essential, if the model is analytically useful. An analogy is the acceptance of continuous methods (e.g. hydrodynamics or elasticity theory) in physics despite our knowledge of subatomic particles.

The various schools of thought are not always in direct competition with one another, even though they sometimes reach differing conclusions. Macroeconomics is an ever evolving area of research. The goal of economic research is not to be "right," but rather to be useful (Friedman, M. 1953). An economic model, according to Friedman, should accurately reproduce observations beyond the data used to calibrate or fit the model.

Macroeconomic schools of thought

The traditional distinction is between two different approaches to economics: Keynesian economics, focusing on demand; and neoclassical economics based on rational expectations and efficient markets. Keynesian thinkers challenge the ability of markets to be completely efficient generally arguing that prices and wages do not adjust well to economic shocks. Neither view is typically endorsed to the complete exclusion of the other, but most schools do emphasize one or the other approach as a theoretical foundation.Keynesian tradition

Keynesian economics was an academic theory heavily influenced by the economist Keynes. This period focused on aggregate demand to explain levels of unemployment and the business cycle. That is, business cycle fluctuations should be reduced through fiscal policy (the government spends more or less depending on the situation) and monetary policy. Early Keynesian macroeconomics was "activist," calling for regular use of policy to stabilize the capitalist economy, while some Keynesians called for the use of incomes policies.

Neo-Keynesians combined Keynes thought with some neoclassical elements in the neoclassical synthesis. Neo-Keynesianism waned and was replaced by a new generation of models that made up New Keynesian economics, which developed partly in response to new classical economics. New Keynesianism strives to provide microeconomic foundations to Keynesian economics by showing how imperfect markets can justify demand management.

Post-Keynesian economics represents a dissent from mainstream Keynesian economics, emphasizing the importance of demand in the long run as well as the short, and the role of uncertainty, liquidity preference and the historical process in macroeconomics.

Neoclassical tradition

For decades Keynesians and classical economists split in to autonomous areas, the former studying macroeconomics and the latter studying microeconomics. In the 1970s New Classical Macroeconomics challenged Keynesians to ground their macroeconomic theory in microeconomics. The main policy difference in this second stage of macroeconomics is an increased focus on monetary policy, such as interest rates and money supply. This school emerged during the 1970s with the Lucas critique. New Classical Macroeconomics based on rational expectations, which means that choices are made optimally considering time and uncertainty, and all markets are clearing. New Classical Macroeconomics is generally based on real business cycle models.

Monetarism, led by Milton Friedman, holds that inflation is always and everywhere a monetary phenomenon. It rejects fiscal policy because it leads to "crowding out" of the private sector. Further, it does not wish to combat inflation or deflation by means of active demand management as in Keynesian economics, but by means of monetary policy rules, such as keeping the rate of growth of the money supply constant over time.

Macroeconomic Policies

In order to try to avoid major economic shocks, such as The Great Depression, governments make adjustments through policy changes which they hope will succeed in stabilizing the economy. Governments believe that the success of these adjustments is necessary to maintain stability and continue growth. This economic management is achieved through two types of strategies.- Fiscal Policy

- Monetary Policy

Notes

- Blaug, Mark (1985). Economic theory in retrospect. Cambridge, UK: Cambridge University Press.- Sullivan, arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 57.

- Frisch, Ragnar (1933). Propagation Problems and Impulse Problems in Dynamic Economics. London: Allen & Unwin.

- Mishkin, Frederic S. (2004). The Economics of Money, Banking, and Financial Markets. Boston: Addison-Wesley. p. 517.

- Mishkin 2004, pp. 518–19

- Mishkin 2004, p. 521

References

- Blanchard, Olivier (2000), Macroeconomics, Prentice Hall.- Friedman, Milton (1953), Essays in Positive Economics, London: University of Chicago Press.

- Heijdra, B. J.; Ploeg, F. van der (2002), Foundations of Modern Macroeconomics, Oxford University Press, ISBN 0-19-877617-9 .

- Mishkin, Frederic S. (2004), The Economics of Money, Banking, and Financial Markets, Boston: Addison-Wesley, p. 517.

- Snowdon, Brian; Vane, Howard R. (2005), Modern Macroeconomics: Its Origins, Development And Current State, Edward Elgar Publishing.

- G⇒rtner, Manfred (2006), Macroeconomics, Pearson Education Limited.